Diva vs Lido

Both Diva and Lido are Liquid Staking solutions, allowing stakers to easily stake their ETH and use it in Defi.

The main difference is in their security and trust components.

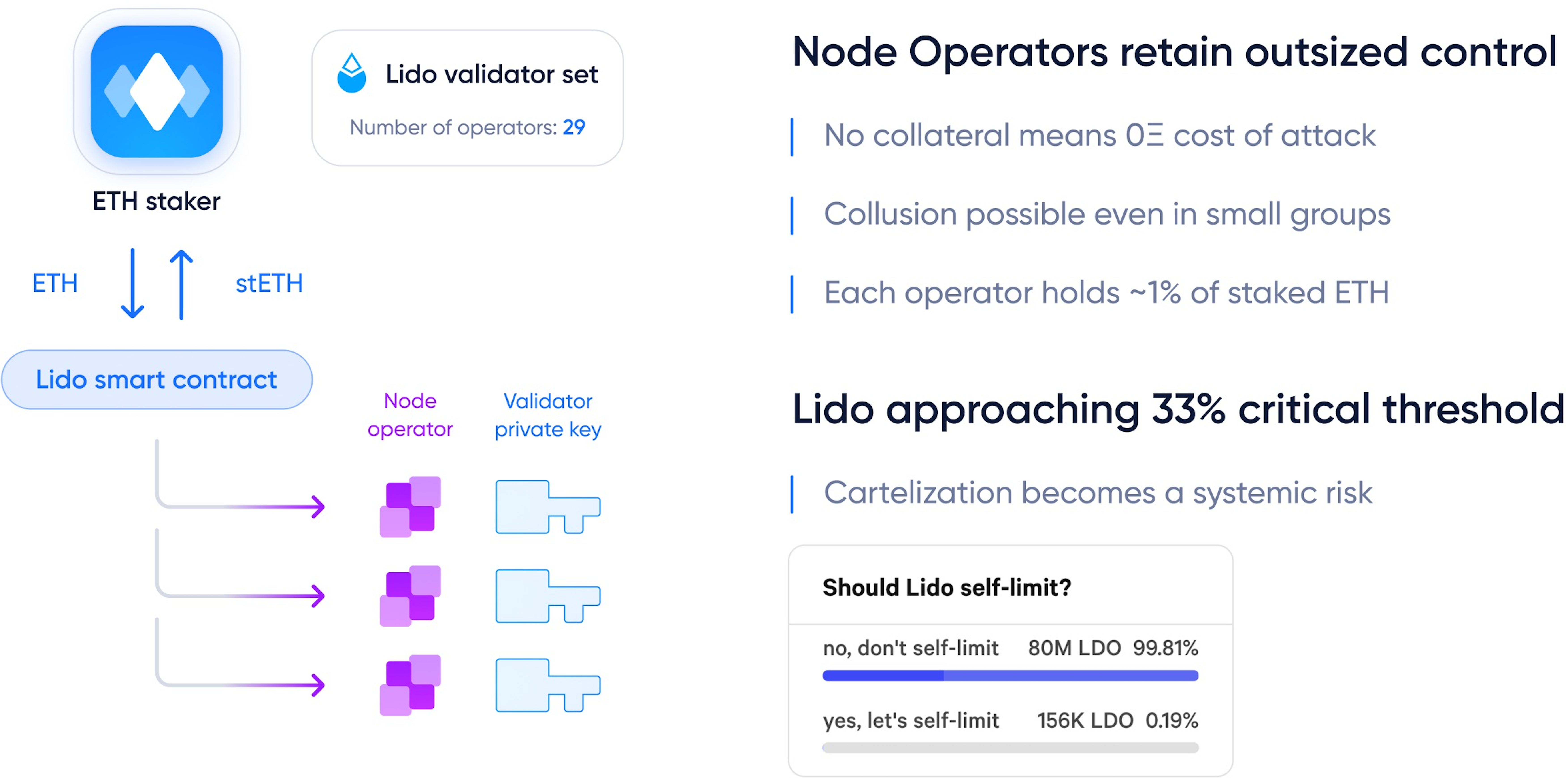

Lido is based on trust and reputation

Lido is operated by a whitelisted set of 29 Node Operators, which are permissioned and uncollateralized.

Each of these Node Operators is handling approximately 1% of all staked ETH, representing hundreds of millions of dollars of responsibility per Operator, without posting any ETH collateral guarantees.

This means that there is no direct guarantee that staker funds will be fully protected from loss of funds.

While Lido has been operating safely in a completely uncollateralized way, their model is fully dependent on the performance of their operators. If their operators suffer from hacks, censorship or law enforcement actions (like the recent actions against Coinbase, Kraken, and Binance), staker funds could suffer losses.

Diva is based on cryptography and incentives

Diva's DVT system provides novel risk mitigation mechanisms, thanks to its fault tolerance and consensus mechanisms preventing single Operators from causing damages.

🏦 Economic protection: Diva Operators are collateralized, providing skin-in-the-game and economic guarantees for Stakers against any potential losses.

💬 Censorship protection: Diva Operators are permissionless, potentially being run by thousands of independent entities with diverse setups and geographies.

🔐 Hack protection: Diva Operators don't have access to validator keys, so even if they're hacked, they can't unilaterally cause damage to the protocol.

🛡️ Takeover protection: Diva isn't run by any single entity. Diva is a decentralized platform in which decision making power is held its participants, including Stakers and Operators.